When launching their own business, every entrepreneur must complete several essential procedures. The initial phases involve creating a business strategy, selecting a name for the company, selecting a site, and other things. However, picking the types of business organizations is a crucial step as well.

It’s crucial to choose the right business organization types when starting out. Because your business structure determines what kind of business entity you are in the eyes of the IRS, it directly affects how your company is taxed.

Not only that, but your company’s structure also determines who is an owner, who controls the management, who is merely an investor, how profits and losses are reported, and much more. The nature of business organizations can affect your business in many ways. So simply put, don’t ignore it.

We will discuss the 6 main forms of business organization in detail in this article. So without wasting your time, let’s get started.

What Is Business Organization?

A business organization is made up of one or more companies that are controlled by the same individual or group of persons. There could be one or several enterprises within an organization.

There can only be one organization within a business. Even in the case of franchises, the franchisor has a distinct business model from the franchisee. However, they coexist inside the same value system.

The legal ties that link them are very different from the employer-employee relationship within the company. Organization and business are interdependent. They are just two sides of the same entity. Consider the influence of culture (the organizational DNA) on a company’s success or failure.

So when discussing strategy and strategic management, business and organization are combined to form business organizations.

Now we know what is business organization is. So let’s get into the main content. Here are the 6 main types of business organizations that entrepreneurs must know.

6 Main Types Of Business Organizations That Entrepreneurs Must Know

1. Sole Proprietorship

The most popular type of business structure is a sole proprietorship. One person handles business on their behalf. There is no such thing as a sole proprietorship under the law. It doesn’t have a life of its independence from the proprietor of the company.

The simplest type of business is a sole proprietorship. The sole proprietor only needs to begin operating their business, making it simple and affordable to get started.

Contrary to several other types of business entities, such as corporations or LLCs, a sole proprietorship is not required to file a business entity registered with the state business entity filing office before starting a business.

However, it should be emphasized that permits or licenses could be necessary if state or municipal legislation mandates them for a specific kind of business.

For instance, a restaurant owner could require particular licenses, like a liquor license, to operate. To provide these services, the state must license plumbers, lawyers, accountants, and other trades and professions.

Obtaining a sales tax certificate is necessary if the sole proprietorship engages in a business that is subject to both state and municipal sales taxes. The company must obtain a Federal Employer Identification Number if it has employees.

The sole proprietor who operates a business under a name different than their real name is another exception to the general rule that no filings are necessary. For instance, if John Jones operates his company under the name ABC CONSULTING, he must file a statement stating that John Jones truly operates his company under a different name.

This name is recognized as an assumed, fictitious, or trade name in many states. According to state legislation, there are specific requirements for filing assumed, fictitious, and trade names.

A sole proprietorship is not only simple to start but also simple to run. Since there is only one owner, that individual also makes all choices. These choices are decided without the need for meetings or votes.

All profits and losses in a sole proprietorship belong to the owner and are reported on his or her income tax return as an additional benefit. The company is not subject to taxation.

The main drawback of running a business as a sole proprietorship is that the owner is personally responsible for its debts.

The single proprietor’s assets may be utilized to cover the business’s obligations if the assets attributable to the business (such as equipment, inventory, cash, real estate, etc.) are insufficient.

2. General Partnerships

A partnership is created when two or more people decide to conduct business jointly. It is a common-law right to conduct business as a partnership. This indicates that no particular state statute is required to establish a partnership.

But laws governing partnerships exist in every state. Most of the default provisions in this legislation only come into play if the partners’ partnership agreement does not address the relevant issues.

These statutes, for instance, stipulate that all partners have equal management powers for the partnership unless a partnership agreement specifies otherwise. Additionally, they are equally distributed among the gains, losses, and income distributions.

Each partner is also given the authority to bind the other partners in relation to the partnership business and is regarded as the partnership’s agent.

An informal oral agreement or a formal written partnership agreement can both be used to form a general partnership.

The normal recommendation is to have a documented partnership agreement. Generally speaking, this written agreement will outline the following:

- Addresses and names of the partners.

- A partner’s relative management and profit rights.

- The partnership’s type of company.

- Duration of the partnership.

- Requirements for accepting and rejecting partners.

- Provisions governing the dissolution of the partnership, as well as any additional provisions the partners see appropriate to control their interactions and how the company is run.

A general partnership includes many of a single proprietorship’s most desirable features. It is simple to set up and use. A general partnership is free from entity-level income taxes. This entity has a “flow through.”

The partners share in both the company’s gains and losses. The most unappealing feature of a single proprietorship is unlimited personal liability, which a partnership also shares.

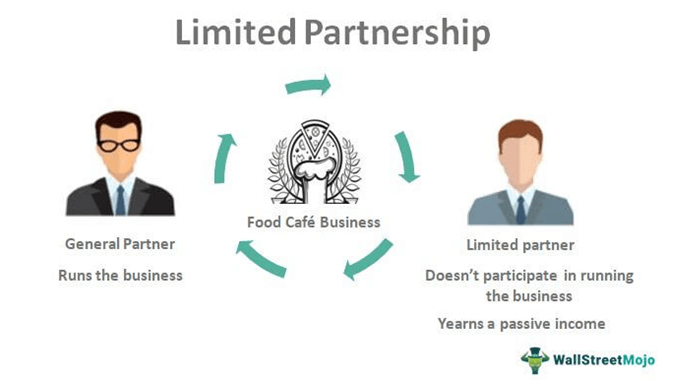

3. Limited Partnership

The two types of partners in limited partnerships (LPs) are general partners and limited partners. The rights, obligations, and responsibilities of general partners in regular general partnerships are the same as those of partners.

They manage the partnership, split profits and losses, and are subject to unrestricted personal liability. Limited partners are partners whose obligations to the company are restricted to the amount they invested.

This limited liability is comparable to that of a corporate shareholder. In general, limited partners are not involved in business management.

Flow-through tax organizations include limited partnerships. Federal income taxes are exempt for limited partnerships.

A limited partnership cannot be created only through business operations. A limited partnership is a recognized type of corporate organization. It can only be created by following state legal procedures.

A limited partnership is required to file a certificate with the details required by the state in which it was formed.

State regulations also typically impose limitations on the name that the limited partnership may select, demand that it appoint and retain an agent for service of process in the state, and demand that filings be made whenever it amends or cancels its certificate.

In accordance with state legislation, foreign (out-of-state) limited partnerships may also obtain a business license by submitting the necessary paperwork.

A few states recently implemented regulations for a specific type of limited partnership known as a limited liability limited partnership, or LLLP. An LLLP is different from a regular limited partnership in that its partners, who otherwise would have unlimited liability, will instead have the same liability as those of a limited liability partnership.

4. Limited Liability Partnership

The limited liability partnership, or LLP, is an additional option that may be selected. A particular kind of general partnership is an LLP. The partners’ exposure to liabilities differentiates a limited liability partnership from a regular general partnership. Limited rather than limitless responsibility applies to partners in LLPs.

The majority of states protect LLP partners from being held accountable for any debts or liabilities of the partnership. However, in some places, the partners are still responsible for other debts and liabilities even though they are not held responsible for debts resulting from the incompetence or misconduct of the other partners.

Registration paperwork must be submitted to the secretary of state or another appropriate filing authority in order for a general partnership to convert to an LLP. Or, in some states, an LLP may be newly established without having previously been a GP.

To conduct business in a state other than the one in which it was formed, a limited liability partnership must first register as a foreign limited liability partnership with that state. Additionally, limited liability partnerships must file an annual report in the majority of states.

5. Limited Liability Company

Another statutory entity is an LLC or limited liability company. It is a “hybrid” entity that combines elements of both partnerships and corporations, yet is neither one. In general, it is created by submitting articles of incorporation to the appropriate state filing officer.

An operating agreement that the owners enter into contains the majority of the clauses governing the internal operations of the LLC. An operating contract is comparable to a partnership contract.

The LLC has risen to prominence as the most common types of business organization in the US in recent years.

An LLC may have one owner or numerous owners. Members of an LLC are the owners of the company. The fact that they are owners does not make the members of an LLC responsible for the company’s debts, similar to limited partners or shareholders.

By serving as managers, the members will not risk their limited liability status and will retain their authority to govern the company’s operations and affairs. If the members choose not to administer the LLC directly, they may also choose to have one or more managers take charge of it.

Flow-through taxes is a benefit to limited liability companies.

A limited liability company is exempt from entity-level income taxes unless it chooses to pay them. Instead, its members benefit from its profits, losses, and other tax-related factors.

A limited liability company must apply for permission to conduct business in the foreign states it operates in if it conducts business there.

According to LLC laws, a foreign LLC’s internal activities and members’ responsibilities are governed by the laws of the state in which it was formed.

6. Business Corporations

The most complicated type of company organization is a corporation. State legislation regulates both its establishment and its workings. An organization set up for profit and governed by one state’s laws is known as a business corporation.

Nonprofit corporations are created in accordance with various legal provisions. Hence they are not addressed in this document.

Even while corporations were previously the most common types of business organization in the US, currently, more LLCs are created than corporations in the majority of states.

The corporation is still the most common and practical alternative for many businesspeople and is still the preferred choice for publicly traded companies.

The following are the top four benefits of operating as a corporation:

- Investors are not held responsible for the corporation’s debts.

- The corporation exists indefinitely.

- The sale of stocks and other securities can be used to raise money.

- Due to the corporation’s centralized management, investors are not required to get involved in day-to-day business activities.

The corporate type of organization has three main drawbacks:

- It costs the most to create.

- It is the most difficult to use.

- It is subject to “double taxation,” which means that the income is taxed twice: first when it is earned by the company and again when it is delivered to its shareholders in the form of dividends or distributions upon the business’s liquidation.