With more people discovering the advantages and joys of being their own boss, freelancing has grown in popularity in recent years. Due to the abundance of online project management tools and communication platforms, freelancing has become more widely available.

While freelancing can be profitable, some people find it challenging to handle the unpredictable money flow. Do not worry; that’s where financial planning for freelancers comes in!

You should learn financial Management for Freelancers. You’ll have better financial management after reading these finance tips for freelancers.

What Is Financial Planning For Freelancers, And Why Is It Important?

Simply put, financial planning for freelancers is a long-term approach that enables you to cover your expenses both now and in the future while minimizing the effects of unforeseen events.

Financial planning not only helps in managing the less appealing aspects of freelancing but also aids in covering the price of fixed charges (such as rent or utility payments).

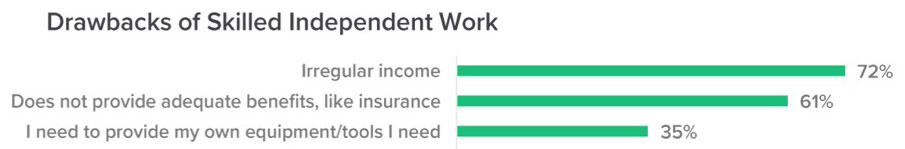

The top three disadvantages of freelancing are inconsistent pay, a lack of benefits, and the need to provide their own tools and equipment, according to freelancers who took part in Fiverr’s 2020 Annual Freelance Economic Impact Report.

Freelancers must rely on their own financial planning to handle these costs, unlike full-time employees of a company who frequently have benefits and tools to work with. This is particularly relevant given the erratic nature of paychecks when performing contract labor.

Financial planning for freelancers assists in the development of a secure future in addition to lowering monthly expenses. Consider that you want to buy a home or have kids. Financial plans for freelancers enable you to spread out your current income to pay for some of these upcoming obligations.

Financial planning for freelancers also enables you to remain afloat should circumstances change and helps you prepare for job advancement.

You are less vulnerable to the effects of adverse events, such as the loss of a customer or a decline in the market, if you have a solid financial plan in place.

Now you know what is financial planning and why it is important. The next question you would raise is “how to manage finance as a freelancer,” so let’s get into the main content of best financial planning methods for freelancers.

10 Best Financial Planning Methods Freelancers Must Know

1. Create A Budget First

If you’ve never had one, the word “budget” can be intimidating. A budget must be a consistent part of your life if you work as a freelancer.

That’s because one of the fundamental realities of freelancing is unpredictable financial flow. You won’t be receiving the same paycheck every two weeks, so you’ll need to figure out how to balance out the highs and lows. To do that, you’ll need a budget.

Making sure that your spending correctly matches your income is the essence of budgeting. Although it’s a straightforward idea, executing it is not always simple. One of the first stages to a freelancer’s secure personal finances is learning the fundamentals of budgeting.

Investing in a budgeting app that can streamline the process can be beneficial. You can set up and manage your funds more effectively with free options like Mint, which are relatively simplistic.

Check out YNAB (“You Need A Budget”) if you want a more thorough budgeting app. It will cost you $11.99 a month or $84 a year, but it might be some of the best money you will ever spend. The average user, according to YNAB, saves $6,000 a year!

You may create and maintain a budget using various budgeting tools. Select the option that most closely matches your requirements and preferences!

2. Don’t Forget About Taxes

Taxes must be paid, but if you have regular employment, much of the work will be done for you. Most of the information you’ll need to file will be on a W-2 form that your employer will provide you, along with any payments withheld. For freelancers, taxes are a little more complicated.

There’s a lot to talk about here, so let’s divide it into two smaller sections:

Recognize Deductible Business Costs

Most costs involved in generating income for self-employed freelancers are deductible.

Examples are:

- Advertising and marketing.

- Mobile phone and the internet.

- If you operate your business from home, you may have a home office.

- Equipment and supplies for businesses.

- Transportation costs associated with your line of work.

- Travel costs for work-related purposes.

- Education in business.

- Tax deductions are also available for costs like health insurance and half of your Social Security tax.

Create Income Tax Estimates

In particular, during the first year of operation, taxes can come as a significant shock to freelancers.

Since you are self-employed, you must regularly pay estimated taxes to cover your expected tax burden for the entire year. Since the penalty for failing to pay taxes might be severe, you should be careful in this regard.

You must submit tax estimate payments to the IRS on an approximately quarterly basis in the US. The following dates are when the payments are due:

- April 15

- June 15 (yes, this one is only two months from the previous estimate)

- September 15

- January 15 of the following year

Calculating your quarterly payments is easiest done by dividing your tax liability from the previous year by four.

That works, provided your income has not changed much from the last year in either direction. You might need to modify your estimates if this year or the previous one has been especially good or bad.

That approach won’t work if this is your first year as a freelancer. Instead, you might need to spend some time crunching the numbers with a tax preparer based on expected income and costs.

It will be beneficial to keep thorough records of your earnings and spending! You can download transaction data that will aid in tracking your income if you accept payments online through services like TransferWise or PayPal.

Self-employed taxpayers can find more information from the IRS, so it’s a good idea to evaluate it routinely.

3. Separate Personal And Business Costs

If your business spending is combined with your personal expenses, keeping track of them can be a real nightmare. You can keep spending separate by using a special company credit card or a bank account.

The ability to deposit earnings from your business into a business bank account is an additional benefit. Tax preparation can be simplified if income and expenses are recorded in the same bank account.

Use one of the various accounting software tools for small businesses if you require further assistance controlling your revenue and expenses. Professional-level accounting features can be found in well-known applications like QuickBooks and FreshBooks.

4. Create Your Own Retirement Plan

Freelancers won’t have access to a 401(k) or pension plan sponsored by their company. You’ll still desire to retire at some point, but you won’t be able to do so unless you plan. The moment has come to start preparing.

Your cash flow will also be impacted by health insurance and retirement plan contributions. The flexibility of retirement plans is far larger than that of health insurance.

A regular or Roth IRA is your most basic option. There are a few significant variations:

Traditional IRAs

Your payments to the plan are tax deductible at the time of contribution, and withdrawals are taxed at the time of receipt. A 10% early withdrawal penalty is added on top of regular income tax if money is removed before the age of 59 and a half. At age 72, you must begin taking withdrawals from your IRA.

Roth IRAs

A Roth IRA’s initial contributions are not tax deductible. You must pay taxes in the year you get the funds. You can take your contributions (but not your investment returns) tax-free and penalty-free whenever you want, provided you’ve owned your Roth IRA for at least five years.

Roth IRAs do not require distributions at any age. You can hold onto them later in your retirement or even give them tax-free to your heirs.

Traditional And Roth IRAs Have Similarities To Each Other

The maximum contribution is $6,000 per year for standard IRAs and $7,000 if you are 50 or older for Roth IRAs.

The total IRA contribution is not required every year. Beginning with $1,000 the first year, increase it by $1,000 each succeeding year until you reach the maximum contribution amount.

Starting small will allow you to gain momentum. Meanwhile, your contributions to a regular IRA will be tax deductible, which will benefit you financially.

Furthermore, you are free to hold an account with the investment broker of your choice, select your own investments, and take advantage of tax-deferred investment income with either plan.

Freelancers’ Access To Social Security

When you work a regular job, your employer will take Social Security taxes out of your pay. Additionally, up to $3,825 a year, employers will match those contributions.

You must provide both contributions yourself if you work as a freelancer because you are both an employer and an employee. When you submit your yearly income tax return, you will pay these payments.

When you retire, you will be eligible for Social Security and Medicare benefits if you have paid social security taxes for at least ten years. Your benefits will be greater the more you contribute throughout your working career.

Although the benefits first may appear like a burden, they eventually may prove to be quite helpful. You can find more details on Social Security for independent contractors (PDF).

5. Create An Emergency Fund That Is Well-Stocked

Freelancers’ personal finances can be quite unpredictable. There may be times when money is tight, no matter how diligently you budget your income and expenses. You’ll have periods of high income and periods of possibly no income. Consider it an occupational risk or merely a fact of the job.

Making a designated emergency fund is the greatest method to be ready for this unavoidable outcome. You’ll need to be realistic because it could be challenging to do this when you first start out. 30 days’ worth of living expenses in your emergency fund would be a decent beginning target. You’ll eventually want to increase it to the advised 90 to 180 days.

The best way to accomplish so is to adhere to your spending plan even when your income is high so that you may put the extra money into your emergency fund. As a result, it will be present when you need to withdraw money during tough times.

6. Look For Inexpensive Health Insurance

Finding cheap health insurance is not simply personal finance for freelancers issue; it affects almost everyone. However, it is a particular pain point for the self-employed. You are exactly that if you work as a freelancer.

There aren’t many options, which is unfortunate. If your spouse has coverage via their company that can cover you both, that is the most economical method to obtain insurance. You must purchase a separate health insurance policy if you are not married or if your spouse is not covered.

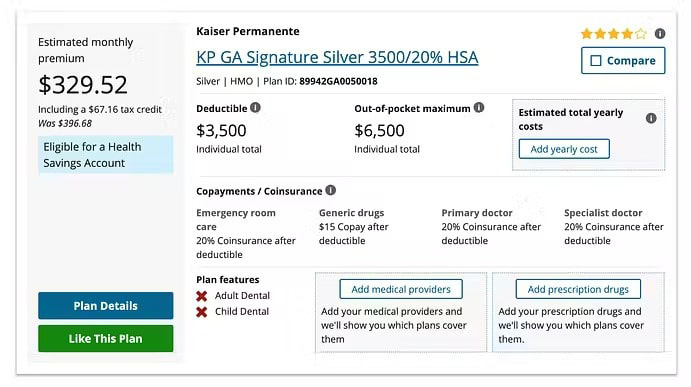

Through healthcare.gov in the US, you may look up plan costs. A 30-year-old single woman with a $40,000 annual income who lives in the Atlanta metropolitan region was used as a sample.

Undoubtedly, a $3,500 deductible is not cheap, especially if you work freelance. Plans with lower deductibles, however, will cost hundreds per month more in premiums. Take note of the $6,500 “out-of-pocket maximum” as well. You might be liable for that sum if you suffer a major illness or injury.

You might need to settle with a lower cost/higher deductible plan in the interim until your cash flow situation improves and becomes more predictable.

Early in your company career, it may seem like health insurance is an unnecessary investment, but one mid-level medical incident is all it takes to land you in bankruptcy court. Finding insurance is one way to stop that.

Out-of-pocket costs, though, can ruin you financially even if you have insurance. It pays to have a healthy emergency fund or a tax-advantaged Health Savings Account in addition to your insurance.

7. Spread Out Your Sources Of Revenue

One of the most important distinctions between an employee and a freelancer is that the former often depends on one reliable source of income while the latter depends on several.

Your cash flow will be more consistent with the more sources of income you have. The ups and downs that force you to use your emergency fund when your income declines are lessened.

When your account balance regularly shows a surplus over your outgoing expenses, your business is successful.

A key component of self-employment is identifying new revenue streams. Regularly looking for fresh sources will be necessary.

You can find new clients in various ways, for instance, if you work as a freelance writer. The two most common are sending out pitch letters to potential clients and engaging in referral networks. You should make this part of your usual operating practice. I can tell you as a freelance writer myself.

8. Pay Your Debts

Debt repayment should come first, even though it may be a long-term financial objective. You continue to make more payments when you are in debt to repay the interest. Your pocket gets emptied of profits as a result.

Debt impacts your ability to use other financial services in the future in addition to your ability to earn money today. You’ll find it more difficult to obtain business loans or additional credit lines to grow your organization in the future if you have debt or a low credit score.

9. Pay Yourself A Salary

According to business guru Tony Robbins, although contracting can be an economic rollercoaster with peaks and valleys, “give yourself the gift of a stable paycheck.” Your stress level will drop, and creating a monthly budget will be much simpler.

Knowing how much money is entering your own bank account each month makes it much simpler to adhere to a personal budget and pay for all costs.

Additionally, when business is booming, any excess income over your predetermined compensation amount is kept in your business account and used to pay your salary during periods of slower business growth.

10. Establish Your “Deal-Breaker” Prices

Do you have a firm understanding of the value of your services? Research the going prices for freelancers with your degree of training and experience. You don’t want to waste your time on clients that aren’t paying you enough because doing so will make you feel exhausted.

To expand your portfolio, if you’re beginning from scratch, you might have to charge modest fees until you can start charging more. However, if you have some expertise, ensure you are getting paid appropriately and be ready to leave if a client cannot match your “deal-breaker” rates.