Money is now a unit on which even social status is based. Saving money is especially important for those who do jobs and are still learning. There are a lot of money-saving tips and methods on the internet. But some of them does not suit practically everyone.

We know you get money through one or more of the cash flows quadrant. So how to manage and save them?

You may have realized that your finances are not in order and that you need to do something about it. This is why you need to learn about the different ways of saving money. Below are some of the money-saving tips that you can save money fast and reach your goals sooner than you expect.

1. Start Small

The main reason why most people find it hard to maintain saving habits is that they start big. They tend to keep all their money only to end up not having any money for their personal use. This makes an individual go back to his or her savings account and withdraw all the money that he or she had. The best way to save is to start small.

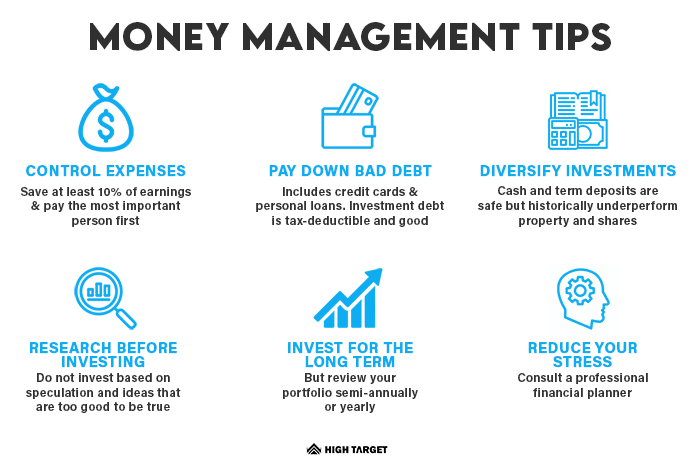

2. Pay off your Debts

Paying off your debts is one of the best budget-saving tips that will ensure that you have some extra money with you. The best way to save your money through budgeting is to start by paying off your debts. Once you have completed paying your debts, the interest you were paying for the debts can be channelled to your savings account.

3. Plan your Meals for the Week

Having a meal plan helps you to spend less and save more. However, you can only plan your meals well if you have done your home shopping and bought everything that you need in the house. Food is one of the basic needs that take up more of our money, but with proper meal plans for the week, you can save up on more.

4. Write a shopping list

This is another money-saving tip that you should be aware of. Writing a shopping list helps you to avoid buying the things that you do not need at home. Before you head out for shopping, ensure that you have your shopping list with you and that you follow everything you wrote without adding any item that is unnecessary.

5. Have a Separate Emergency Funds Account

Having an emergency funds account makes you more responsible and ready for any emergency that may arise. Since you always deposit some money into this account, it will be very easy to use that money for any emergencies and not get money out of your personal savings account. Having emergency funds is another form of saving your budget that you need to follow.

6. Have Saving Goals

If you want to achieve your goal fast then you have to save money fast. You need to have a specific goal that you want to achieve written somewhere so that you can keep reminding yourself of why you are saving. For example, if you are saving to buy a house, then you need to write it somewhere visible so that when you see it frequently, you remember to put in more money.

7. Prepare most of your Meals from Scratch

Eating out is one of the activities that drain one’s finances. Preparing your meals at home and packing your lunch to work will help you to save more since you will not waste any money buying expensive food. This is another best money-saving tip that you need to incorporate in your life.

8. Turn off the television when not in Use

When the television is left on for a long time, electricity is being consumed, and at the end of the month, the bill will be so expensive. Since you want to use as little money in the house as possible, you need to switch off the television to save on energy. Replace the time that you spend on television with doing something that is more constructive such as reading a book or creating a puzzle.

9. Make a 30-day Rule

A 30-day rule works in that, if you have an urge to buy something, especially when you have the money for it, then you should give yourself a period of 30 days before purchase. If by that time you will still have the urge to buy it then go for it, but if the urge will have subsided, then do not buy it. Most of the time, we tend to buy items that we do not need simply because we have the money to get them. Following the 30-day rule is a form of budget-saving that will help you keep many coins in your bank.

10. Face your Emotions

Consequently, we tend to spend from how we feel at that particular time. We have discussed how millionaires habits with finance.

For example, if a lady feels less beautiful because she is insecure about how she looks then she might be tempted to go on a shopping spree. Being unable to handle her emotions will harm her finances. She will end up buying clothes that she does not need and go broke because of trying to impress others without doing anything for herself. So she wastes her money without saving. Therefore, dealing with your emotions is among the best money-saving tips that you should follow.

11. Map your Financial Goals

Mapping out your financial goals is very important because it keeps you focused on achieving the specific goal that you have in place. Maybe you are planning to buy a car, and this car costs $2,000,000. You need to know how much you are planning to save, and for how long for you to be able to get the car of your choice. When you know what your targets are, you are most likely to stay on course and continue saving for what you want in the long term. Before you know it, you will have surpassed your savings target.

12. Avoid Drinking and Substance Abuse

Drinking and smoking are some of the most expensive habits that people are unaware of. These two habits hinder your budget saving in that you spend too much money buying alcohol and cigarettes, and after these two have damaged your internal organs, you will again use money in getting treatment. In the long run, this will be very expensive and if you did not have any emergency funds, you will be forced to get into debt to get treatment.

13. Track your Progress

Tracking your budget saving will help you determine if you are on the right track or if you need to make various adjustments in your saving habits. If you find out that you are on the right track, then you need to keep saving, but if you realize that you are not achieving your goals then you need to take a step back and determine what is making you drag behind and fix it as early as possible.

14. Reward yourself Cautiously

As much as you are trying to work on your finances, it is advisable that you reward yourself once in a while. You can do this by buying a small gift for yourself or going to pamper yourself by getting massage services or any other fun activity. However, when rewarding yourself, be careful and ensure that you do not spend too much money in a day; only to end up broke the next day.

15. Take as many ‘staycations’ as you can

Well, ‘staycation’ is a term that you are probably familiar with. Since you are trying to work on your money-saving tips, make sure that you minimize your travelling as much as possible. Instead of spending thousands of dollars on a road trip, with your friends, you can invite them over to stay even for the weekend, and turn the house into a fun environment. You can play games, decorate the rooms, watch a movie and engage in other fun activities. Taking as many ‘staycations’ as you can help you to cool down and enjoy every single bit of your home that you never knew existed.

Consequently, you may have an urge to go out to social events, and you know that going out results in spending extra money just for you to enjoy another person’s company. Therefore, to resist that urge, you can invite your friends over for the ‘staycation’ and have even a dinner party.

16. Work within your Budget

Most of the time, we tend to go overboard with our budget. This happens almost all the time especially if you are carrying more money than you should have. For instance, if you have a budget for buying a house item that costs $20,000 then you should stick to looking for that specific item. You can look for other alternatives if the one you wanted is unavailable, but ensure that the new budget that you are working with is reasonable and is not beyond what you planned for earlier. It is better if the item costs less instead of adding more money to what you originally planned.

17. Have a spending limit on Family Gifts

When buying gifts for family, do not spend more than you can manage. Be realistic in the kind of gift that you want to get your family and budget for it. Some people have even made it a habit of getting gifts for their loved ones earlier so that when it is time to give these gifts, you are all set and good to go. If you chose to buy a gift on the same day that you are supposed to give it then go for something affordable that you know your recipient has wanted for the longest time.

18. Live Affordably

One major mistake that most people make when they have money is to live largely. This is the main reason some educated peoples also getting poor soon. When they got the salary end of the month then they might think they are millionaires. So they spend that money on unnecessary stuff without investing or saving a single cent. How they save money that way? it impossible for them. Living below your mean is a millionaire habit. In that way, you can save more money fast without spending a lot of money unnecessarily.

19. Bargain as much as possible

If you are a business person then you already know how to bargain correctly and get a better result through it. Bargaining is one of the best and effective ways to save money fast and easily. Consequently, you can buy anything cheaper than its actual price. It depends on your skill of bargaining. This will very helpful when you have less budget and have more things to do. So try to decrease the price by bargaining as much as you can.

20. Protect your gadgets

Equipment repair is one of the things that adds a lot of extra costs. Everyone cares about money but not about things that they bought with money. Not just gadgets, but everything you lose money on when it crashes should be protected and used. That way, you can use everything for a longer period and save money on repairs. If you have a family or patterns then teach these saving tips for them, teach them to protect all the tools and equipment. Because you can’t do this alone.

21. Open a Savings Account

Opening a savings account helps you to restrict the amount of money that you will be using. In addition to that, putting your money in a savings account gives you higher interest rates as compared to keeping money in your personal account. After you have paid all the necessary bills that need to be cleared, then you can put the balance in your savings account and let it stay there for the longest time. It will start generating interest, meaning that you will get passive income. This money-saving tip is very effective in helping you make extra cash without much effort.

22. Cancel unnecessary subscriptions

Check to see if there is a subscription you have applied for, monthly or annually. And check all those are necessary or unnecessary. Find and close all unnecessary subscriptions from your list. You can save more money by cancelling all those unwanted subscriptions from your list. It might be a domain, Netflix, any other internet service that you not using and paying annually or monthly fee.

23. Fix problems before they become problems

Problems always waste our money and time. So we can save money detecting all those problems earlier and solve them before they become problems. For example, if a tree branch is facing your roof, be sure to cut it down before it destroys your roof. If it falls on the roof, your costs will double or triple. Saving money is easy but you should do the right thing at the right time, then you can save your budget fast and grow soon.

Conclusion

In summary, it is important that we work towards budget-saving. This not only helps us to stay on track with our finances, but it also makes an individual be self-disciplined and develop positive saving habits in the long run. Therefore, all of the above are some of the money-saving tips that you need to incorporate into your life. So we would love to know what are your favourite tips and what is your experience of saving money.